Table of Contents

Key Points

- RLJ Lodging Trust’s H1 revenue slipped marginally to $691.2 million amid softer occupancy and renovation-driven room availability limits.

- Net income fell 24.35% to $31.8 million as margin pressures and weaker citywide event demand weighed on performance.

- RLJ maintained strong liquidity of $974 million, supported by $374 million cash and $600 million in revolving credit availability.

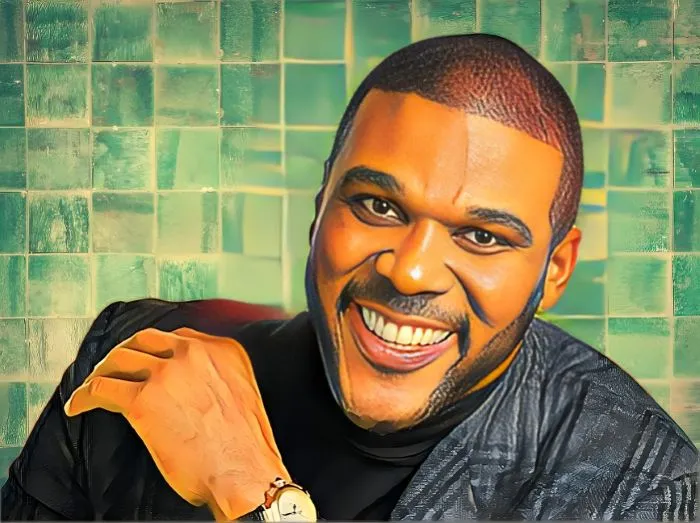

RLJ Lodging Trust, a publicly traded hotel-focused real estate investment trust (REIT) controlled by the world’s first Black billionaire, Robert L. Johnson, delivered a resilient first-half performance in 2025 despite macroeconomic headwinds and renovation disruptions.

The REIT posted total revenue of $691.2 million, edging down from $693.7 million a year earlier as softer occupancy, modest declines in revenue per available room, and ongoing property upgrades temporarily curtailed capacity.

Revenue slips slightly as costs squeeze margins

According to its recently released half-year 2025 report, RLJ Lodging Trust posted a 0.36 percent year-on-year revenue dip to $691.2 million in the first half of 2025, as modest declines in comparable revenue per available room (RevPAR) from $148.71 to $148.19, renovation disruptions, and weaker citywide event demand weighed on results.

Comparable hotel EBITDA fell 3.9 percent to $198.3 million, while adjusted funds from operations (FFO) per diluted share dropped 6 percent to $0.79. Comparable hotel revenue eased 0.2 percent to $690.09 million.

Despite the softer top line, the REIT advanced shareholder returns through capital recycling, repurchasing 0.8 million shares for $6 million in the second quarter, bringing year-to-date buybacks to 3.2 million shares worth $28 million. Liquidity remained strong at $974 million, supported by $374 million in cash and $600 million in available credit. Net income fell 24.35 percent to $31.8 million from $42.04 million, underscoring continued margin pressure in a challenging operating environment.

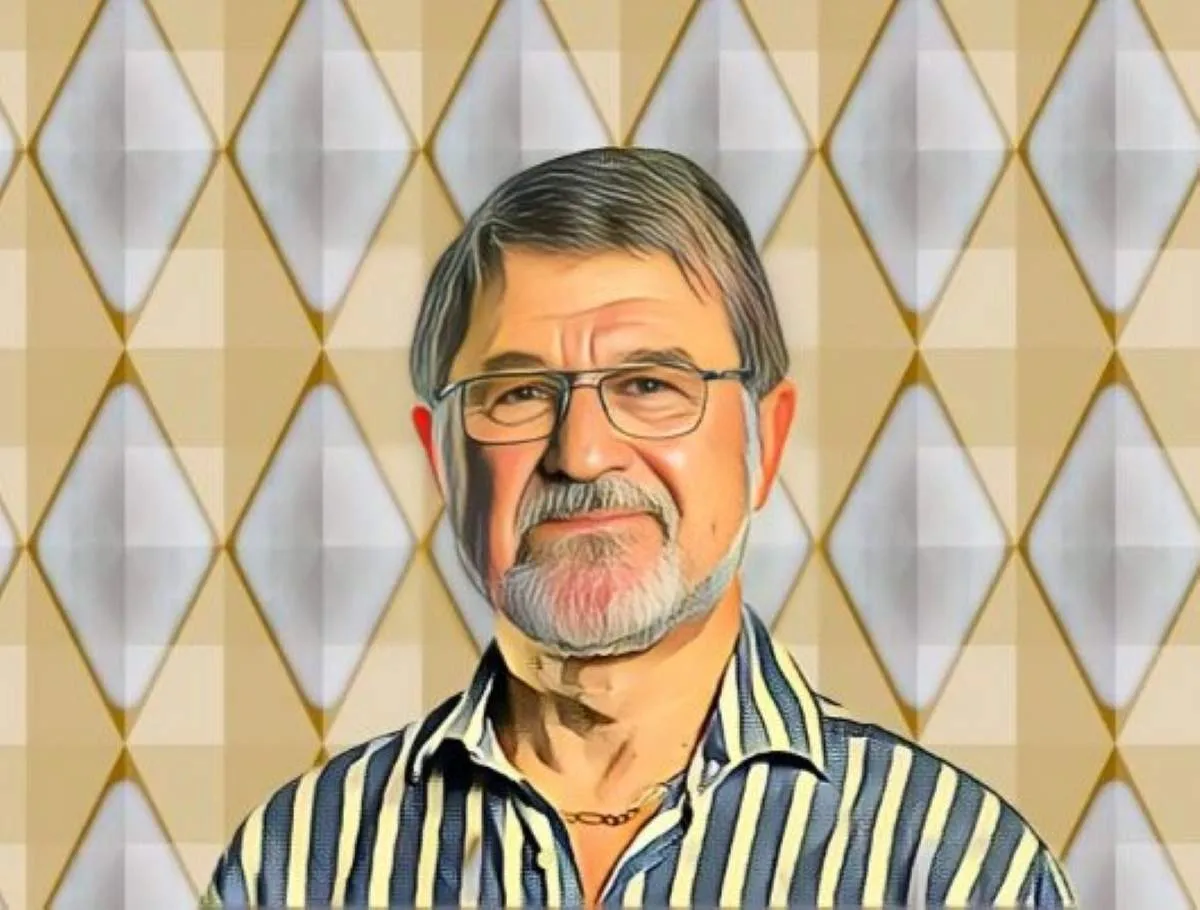

CEO sees Q4 tailwinds amid muted 2025 outlook

President and CEO Leslie D. Hale said second-quarter results topped expectations despite anticipated headwinds. “We are encouraged by the positive tailwinds forming for the fourth quarter, supported by a more favorable calendar, strong citywide events in several markets, and the ramp-up of our conversions and renovations,” she noted.

During the quarter, RLJ refinanced and upsized a $200 million term loan to $300 million, extending maturity to April 2030 and using proceeds to repay its revolving credit facility. The company also extended mortgage maturities totaling $181 million, bolstering balance sheet flexibility.

Assets edge lower, position remains steady

As of June 30, 2025, RLJ Lodging Trust’s assets slipped 1.25 percent to $4.82 billion, while equity fell 2.53 percent to $2.40 billion, reflecting a stable balance sheet.

Founder Robert L. Johnson continues to steer strategy, keeping RLJ among the largest Black-owned public companies in the U.S. Despite cyclical shifts in hospitality, its lean operations, cost discipline, and targeted capital deployment remain key to sustaining returns.

The REIT narrowed its 2025 outlook to the low end of prior guidance, citing weaker Q3 demand and limited macro visibility. It now expects full-year comparable RevPAR growth between -1.0 percent and +1.0 percent, adjusted EBITDA of $332.5 million to $362.5 million, and adjusted FFO per share of $1.38 to $1.58.