Table of Contents

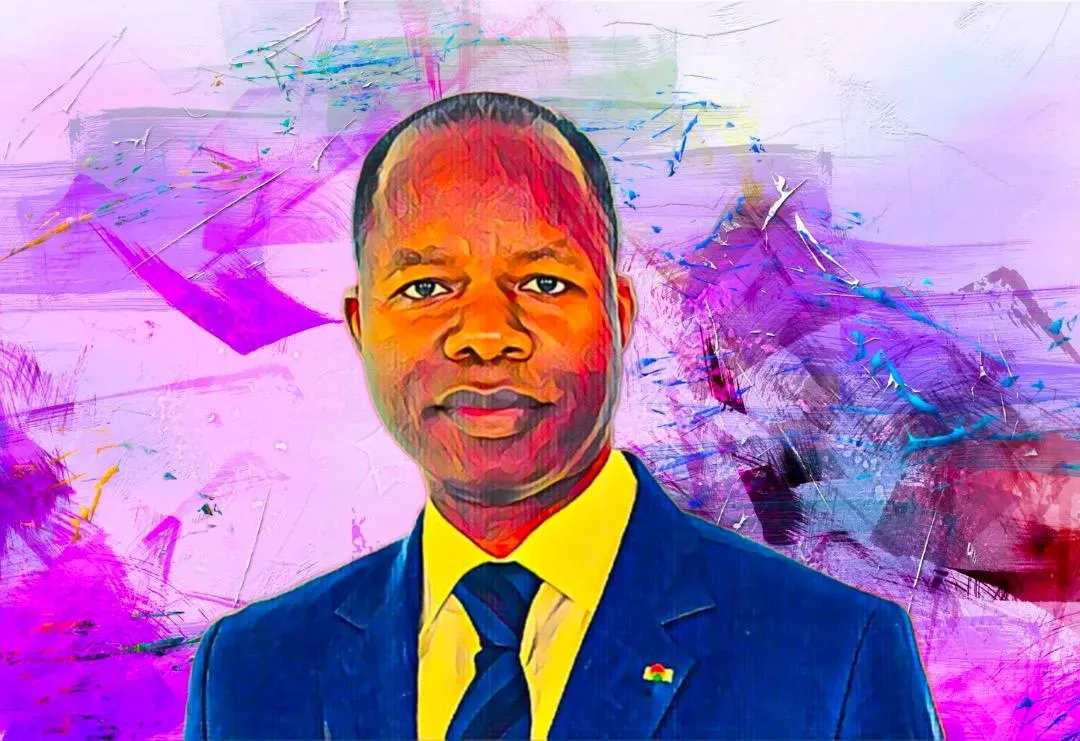

South African billionaire Patrice Motsepe’s net worth has climbed back above $3.5 billion as shares in his mining holdings gain from soaring gold prices.

The founder and chairman of African Rainbow Minerals (ARM) has benefited from his stakes in listed companies, which have been lifted by the commodities market as gold surged past $4,000 per ounce on Wednesday.

Motsepe, who became Africa’s first Black billionaire on the Forbes list, saw his wealth dip briefly between mid-July and early August, falling by $200 million from $3.5 billion to $3.3 billion.

But recent gains in ARM shares and his indirect stake in Harmony Gold have restored his fortune to $3.5 billion, according to Forbes data at the time of drafting this report.

Motsepe stakes in ARM, Harmony rise

Over the past month, ARM, which has interests in iron ore, manganese, platinum group metals, coal, and other base metals, has seen its stock rise 8.1 percent, pushing its year-to-date gains to 23.6 percent.

Harmony Gold, with operations in South Africa, Papua New Guinea, and Australia, has posted even stronger growth, with shares rising more than 25 percent in the past month, bringing its year-to-date gains above 101 percent.

As a result, Motsepe’s 45.9 percent stake in ARM is now valued at R18.2 billion ($1.06 billion), while his indirect 11.8 percent holding in Harmony Gold is worth R24.3 billion ($1.4 billion).

Motsepe gains as gold hits $4,000

The latest jump in Motsepe’s wealth comes as investors flock to gold amid global economic uncertainty. Prices surpassed $4,000 per ounce, a fresh milestone, as markets respond to a dovish outlook from the U.S. Federal Reserve and ongoing geopolitical tensions.

The U.S. government shutdown, now in its second week, has delayed key economic reports, complicating forecasts for the world’s largest economy. Traders are now pricing in potential interest rate cuts in October and December which has further supported gold demand.

Geopolitical concerns fuel safe-haven

Global events are also playing a role. Political unrest in France and a leadership change in Japan are adding to investor caution. Gold has surged more than 50 percent this year as trade conflicts, geopolitical concerns and a weaker U.S. dollar encourage safe-haven buying.

Central banks remain active purchasers, and last month’s Fed rate adjustment contributed to the largest monthly inflow into gold-backed ETFs in more than three years, according to TradingEconomics.