Table of Contents

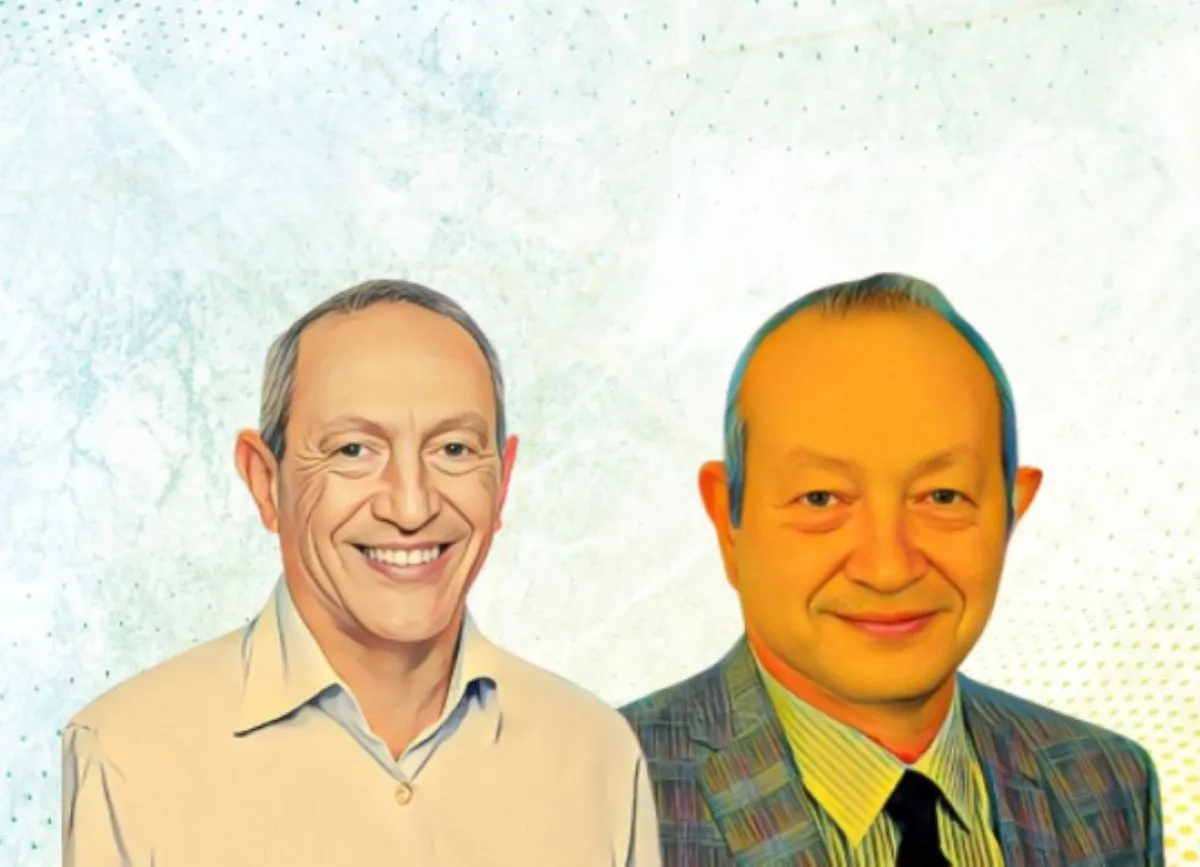

Moroccan billionaire Anas Sefrioui is facing a sharp decline in the value of his investment in Douja Promotion Groupe Addoha after a month-long slide on the Casablanca stock exchange. Since Nov. 3, the market value of Sefrioui’s stake has fallen by $134.91 million, reflecting renewed pressure on one of Morocco’s most closely watched real estate stocks.

Sefrioui, who founded the company and remains its majority shareholder, holds 64.78 percent of Addoha—roughly 260.8 million shares. While he remains one of Africa’s wealthiest business figures, the recent downturn has reduced the value of his holdings to $1.03 billion, down from $1.16 billion in early November.

Weak trading follows short-lived recovery

The slump comes after a brief period of relief earlier in the year. Between Oct. 15 and Oct. 30, Addoha enjoyed a strong rebound, Sefrioui’s stake by $178.6 million and stirring optimism among investors. That reprieve, however, was short-lived as sell-offs resumed in November.

Addoha shares have since fallen 16.14 percent, slipping from MAD41.10 ($4.46) on Nov. 3 to MAD36.33 ($3.94) today. The company’s market capitalization has dropped below $1.6 billion, trimming returns for both retail and institutional shareholders.

Investors feel 18 percent share dip

For more than three decades, Addoha has played a central role in Morocco’s property development, especially in the affordable housing segment. The company has delivered tens of thousands of units across cities such as Casablanca, Ain Aouda, El Jadida and Tetouan, supporting government programs aimed at reducing the national housing deficit.

Since January, the company’s shares have fallen 18.01 percent. A $100,000 investment in the company’s shares at the start of 2025 would now be worth about $81,990, a paper loss of $18,010. The recent dip underscores the volatility facing Morocco’s real estate sector, and for Sefrioui, it marks one of the steepest paper losses tied to his flagship company in recent years.