Table of Contents

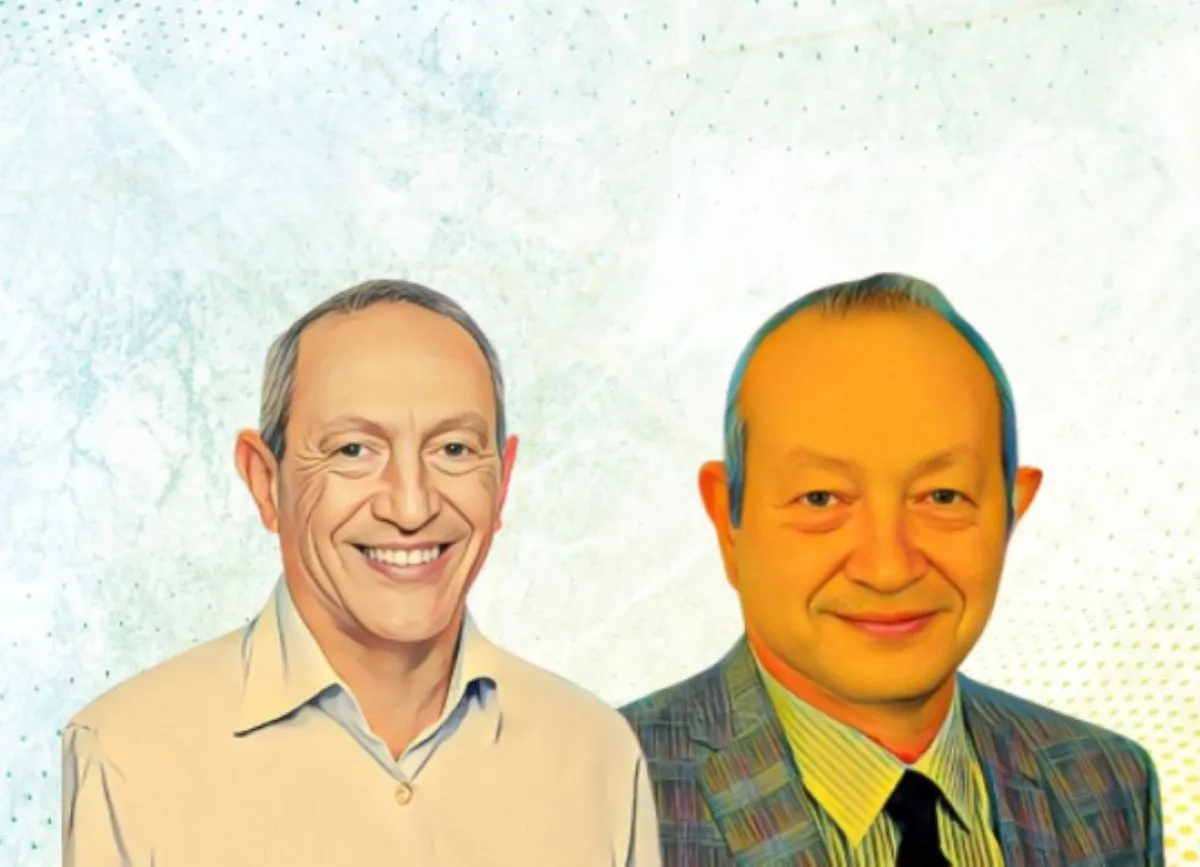

The Ghabbour family, one of Egypt’s wealthiest business families, has watched the value of its controlling stake in GB Corp. slip by more than $30.7 million, after a sharp pullback in the automaker’s shares on the Egyptian Exchange.

Ghabbour family loses $30.7 million

The family controls 63.4 percent of GB Corp., equivalent to 688.2 million shares. Just weeks ago, that holding was valued at about EGP19.33 billion ($406.67 million). As of early December, it had fallen to EGP17.87 billion ($314.42 million), erasing EGP1.46 billion ($30.7 million).

The decline stands in contrast to the gains recorded earlier. Between Sept.23 and Oct. 23, a rally in GB Corp. shares lifted the value of the family’s stake by more than $53 million, briefly adding to the family’s paper wealth before the market reversed course.

Market cap slides below $590 million

Founded in 1985 by the late Raouf Ghabbour, GB Corp. is one of the largest automotive companies in the Middle East and North Africa. The Ghabbour family continues to steer the business, overseeing both strategy and day-to-day operations. With the family holding a 63.4 percent stake, most of its wealth remains closely tied to the performance of GB Corp’s shares.

Over the past 23 days, GB Corp’s share price has slipped 7.55 percent, falling from EGP28.09 ($0.59) on Nov. 16 to EGP25.97 ($0.54). The decline has dragged market capitalization below $590 million, thus impacting the controlling Ghabbour family and minority shareholders alike.

Long-term gains, short-term pressure

Despite a recent sell-off, GB Corp’s performance remains strong. Year to date, its shares are up nearly 46 percent, driven by demand, pricing, and the company’s position in Egypt’s auto market. A $100,000 investment at the start of January would now be worth $145,900.

The drop highlights the risks of holding a large stake in a publicly traded company, where gains and losses can move quickly. For the Ghabbour family, it underscores the impact of market fluctuations on their exposure, even as the company has delivered strong returns over time.