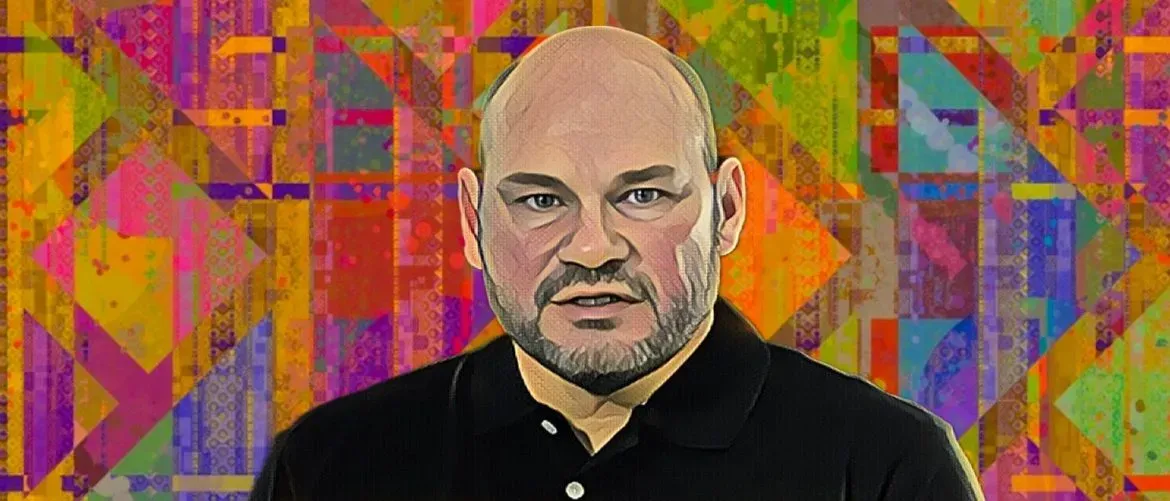

South Africa’s Datatec arm Logicalis buys UK consultancy to boost services

Logicalis UK&I acquires Q Associates to bolster advisory and consultancy strengths, reinforcing Datatec’s push deeper into services-led growth.

Skip to content

Skip to content

Logicalis UK&I acquires Q Associates to bolster advisory and consultancy strengths, reinforcing Datatec’s push deeper into services-led growth.

Uganda’s top court paused enforcement of a $10 million award against businessman Patrick Bitature, giving him temporary relief in his long-running loan dispute.

The JSE imposed a ZAR 5 million fine on Trustco and flagged “unacceptable” conduct tied to the sale of its mining arm without shareholder consent.

Madagascar tycoon Mamy Ravatomanga calls for calm, condemns looting and job losses during nationwide non-violence observances.

Multimillionaire Youssef Moamah leads CMGP’s bold push, acquiring 92.5% of CPCM in a MAD 1 billion ($110 million) deal to expand his chemical-agriculture empire.

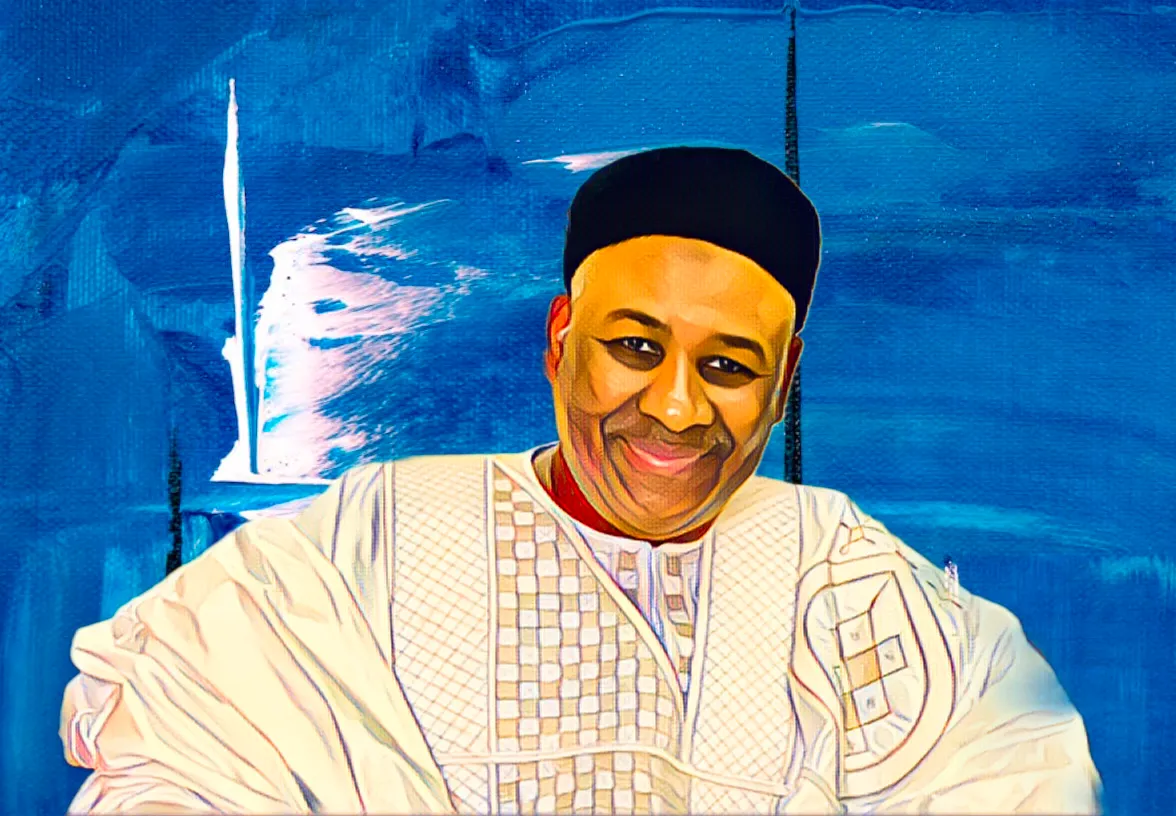

Flutterwave CEO Olugbenga “GB” Agboola unveils a strategy to make stablecoins central to Africa’s payment future, linking it to the continent’s youth-driven fintech boom.

Blu Label’s co-CEOs reaped R74.3m ($4.3m) in 2025, driven by incentive plans tied to Cell C’s restructuring and surging share price.

Nigeria’s leading bank CEOs command giant lenders, yet their own stockholdings remain modest by global standards — raising questions about alignment with investors.

Carlos São Vicente, imprisoned in Angola for economic crimes, was taken to a Luanda clinic for specialist tests, prompting speculation over his health.

At Africa Energy Week 2025 in Cape Town, Rone confirmed the $5 billion FLNG project is nearing FID, with Vitol and Seplat on board.

Econet Wireless Zimbabwe adds Sarah Masiyiwa as alternate director alongside Elizabeth Tanya, cementing the Masiyiwa family’s legacy in the telecom empire.

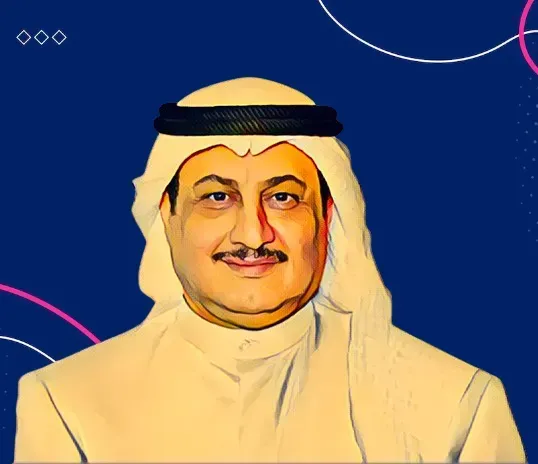

Under Al-Kharafi’s watch, EKH is backing Wafa’s bold push to absorb Delta Insurance and reshape Egypt’s insurance landscape.

Vimal Shah’s Bidco Africa explores a partnership with Egyptian Swiss Group to expand food manufacturing and strengthen supply chains across East and Central Africa.

Mustapha Fasinro’s Linetrale secures LNG cargoes from NNPC, signaling a rare breakthrough for a Nigerian firm in the international gas market.

Oumarou Fadil is putting 1 billion CFA francs ($1.79 million) into a Garoua agro-processing plant, leveraging fresh tax breaks to boost Cameroon’s food output.

A Nigerian court halts PENGASSAN’s planned strike against Dangote Refinery amid warnings of sabotage and fuel supply risks to Africa’s biggest economy.