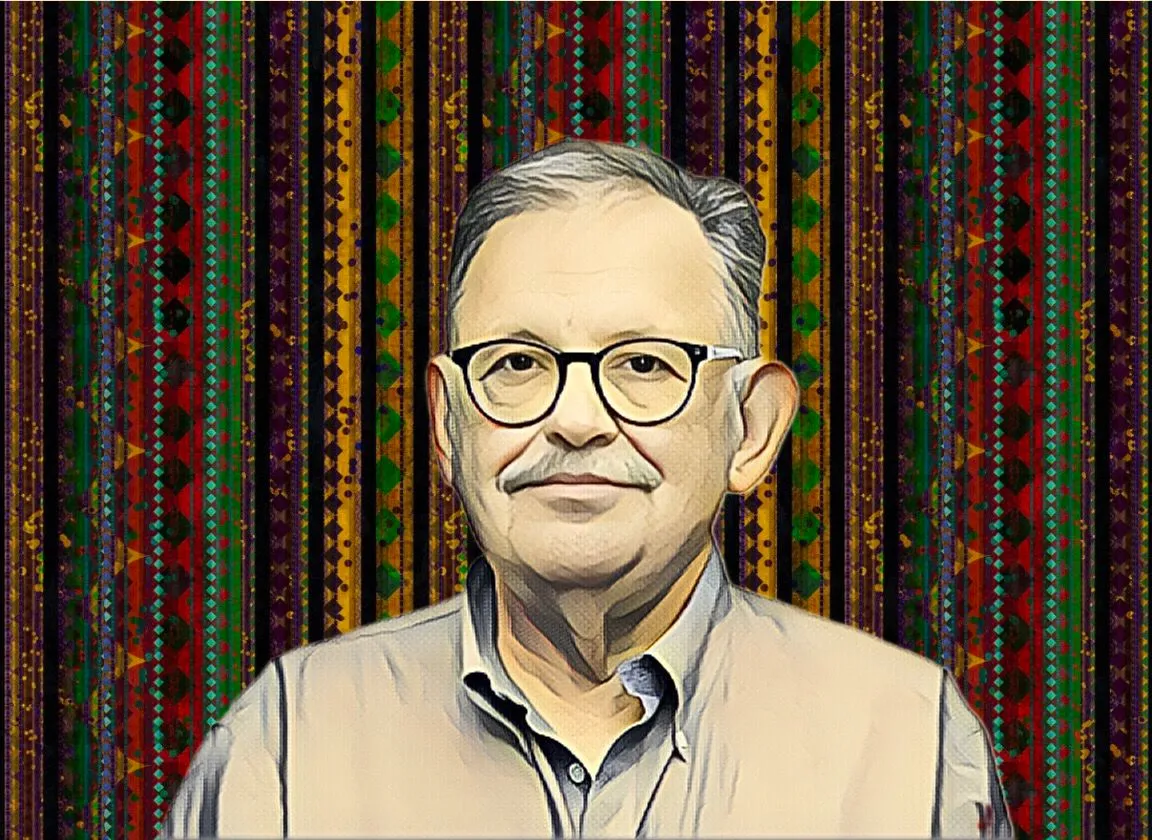

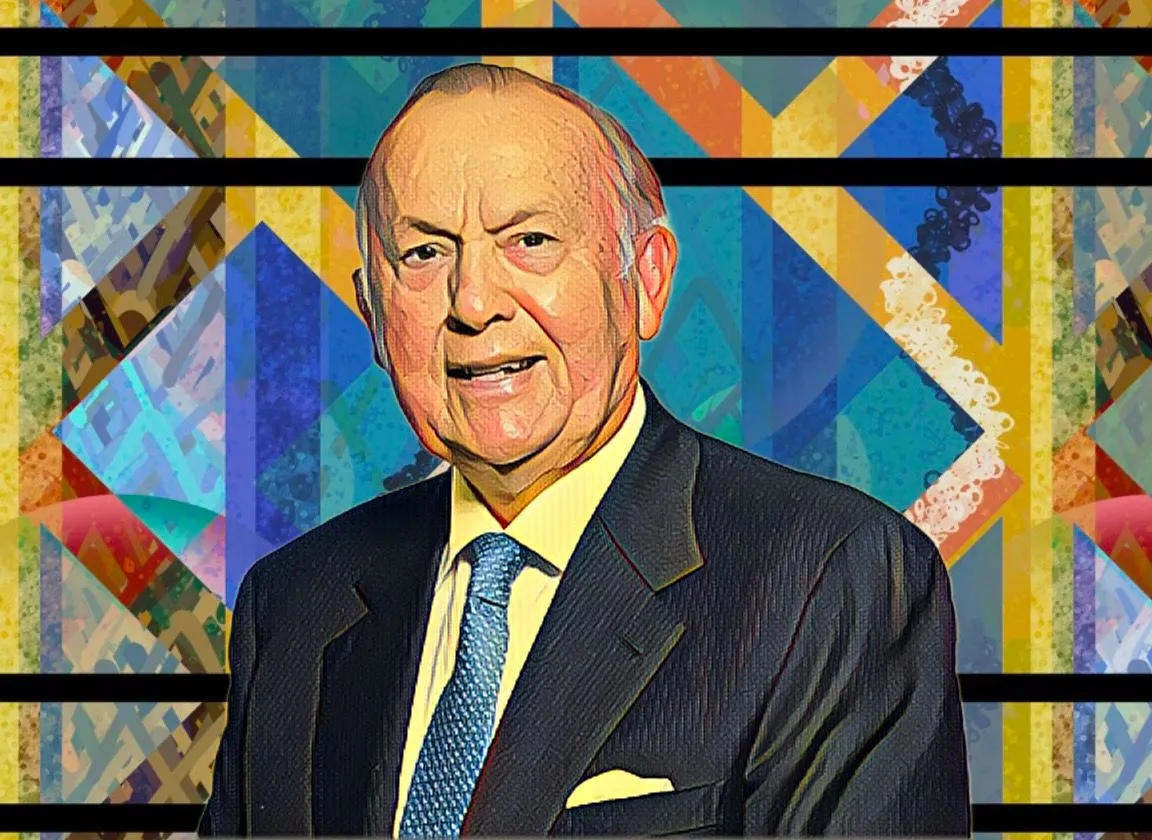

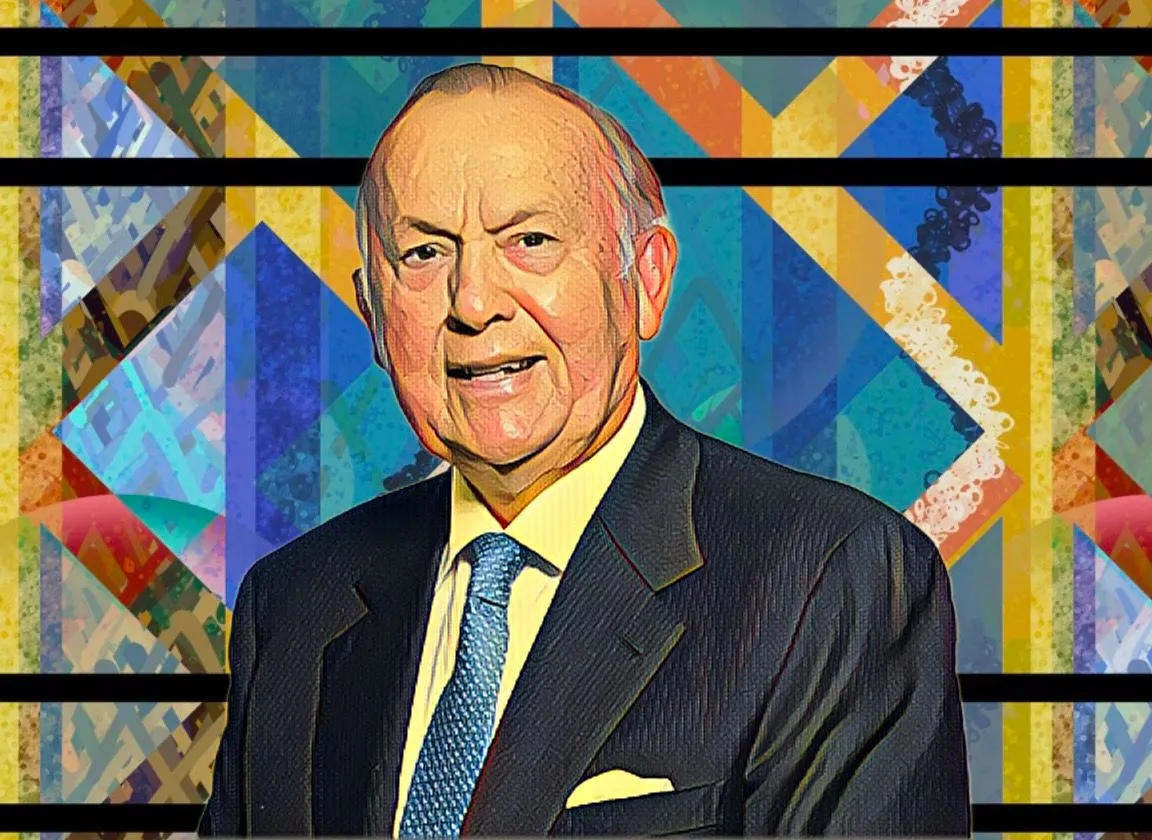

Christo Wiese's Shoprite reports $348-million profit in 2024

Shoprite Holdings reports robust 2024 financial performance amidst economic challenges.

Skip to content

Skip to content

Shoprite Holdings reports robust 2024 financial performance amidst economic challenges.

The company's revenue surged to $4.3 billion, primarily driven by strong sales growth in its core South African operations.

Sanlam Life, a subsidiary of Africa's leading insurer Sanlam, has announced plans to acquire a 25-percent stake in ARC Financial Services Holdings.

South African tech mogul Zak Calisto's fortune surges by $65 million amid Karooooo's market rally