Table of Contents

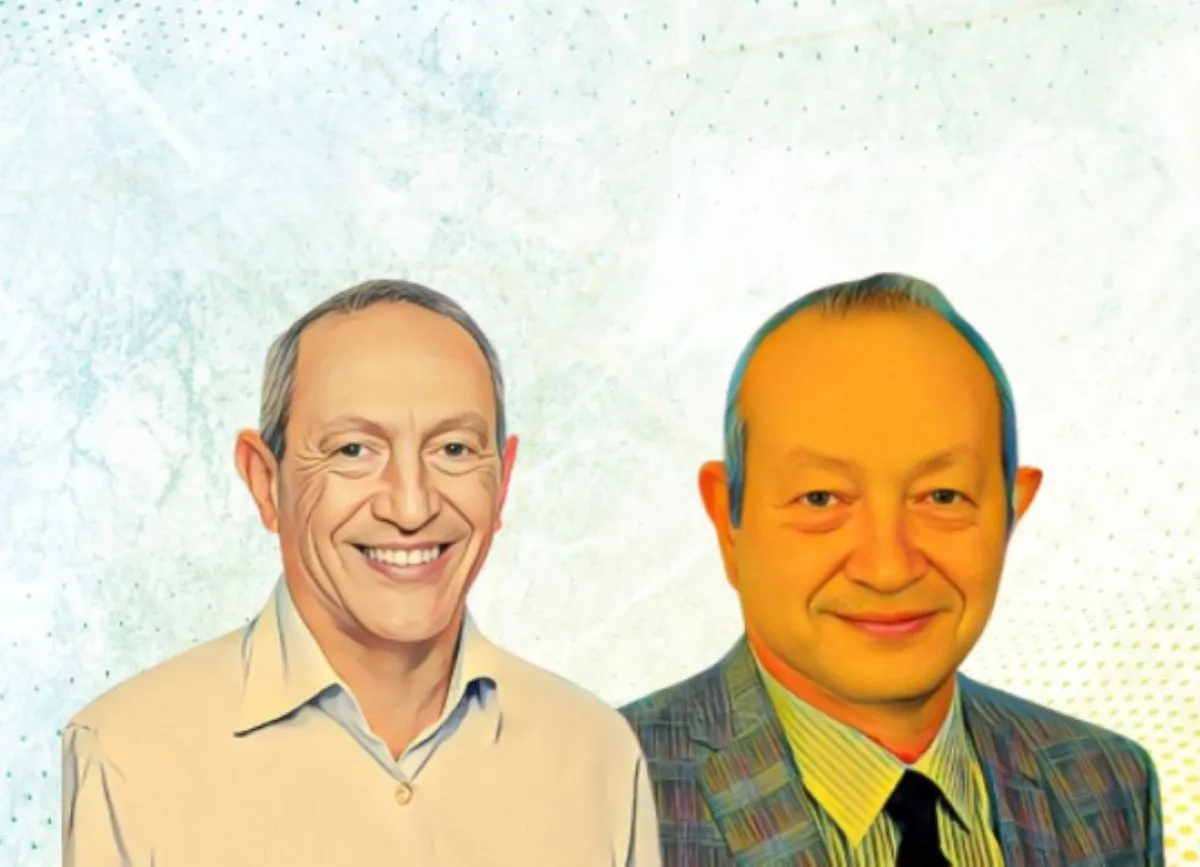

Egyptian billionaire Yasseen Mansour, chairman of Palm Hills Developments, has seen the value of his stake in the real estate company fall by $6.55 million. The decline comes as Palm Hills shares have faced selling pressure on the Egyptian Exchange over the past two weeks.

Share decline hits Yasseen Mansour’s Palm Hills stake

Mansour holds a 10.83 percent stake in Palm Hills, equivalent to roughly 318.57 million shares. Over 42 trading sessions, the value of his holdings fell from EGP2.58 billion ($53.5 million) to EGP2.26 billion ($46.96 million), marking a significant loss following previous declines.

Earlier this year, Yasseen Mansour’s stake recorded a $10 million drop between July 9 and Aug. 20, falling from EGP3.06 billion ($62.89 million) to EGP2.57 billion ($52.89 million), reflecting ongoing pressure on Palm Hills shares and investors’ cautious sentiment toward the stock.

Palm Hills faces market headwinds

Part of the Mansour Group, Palm Hills Developments is one of Egypt’s largest family-owned real estate companies. The firm is known for high-end homes, commercial properties and resorts that appeal to local and international buyers.

Over the last 15 days, Palm Hills shares have dropped 12.24 percent, sliding from EGP8.09 ($0.168) on Aug. 28 to EGP7.1 ($0.147). The decline dragged the company’s market cap below $425 million, impacting Yasseen Mansour and both institutional and retail shareholders.

Modest gains remain for 2025 early investors

Despite recent losses, Palm Hills shares are up 2.31 percent since the start of the year. For investors who bought into the company on Jan. 1 a $100,000 stake would now be worth $102,310 reflecting a modest gain that shows resilience despite short-term setbacks.