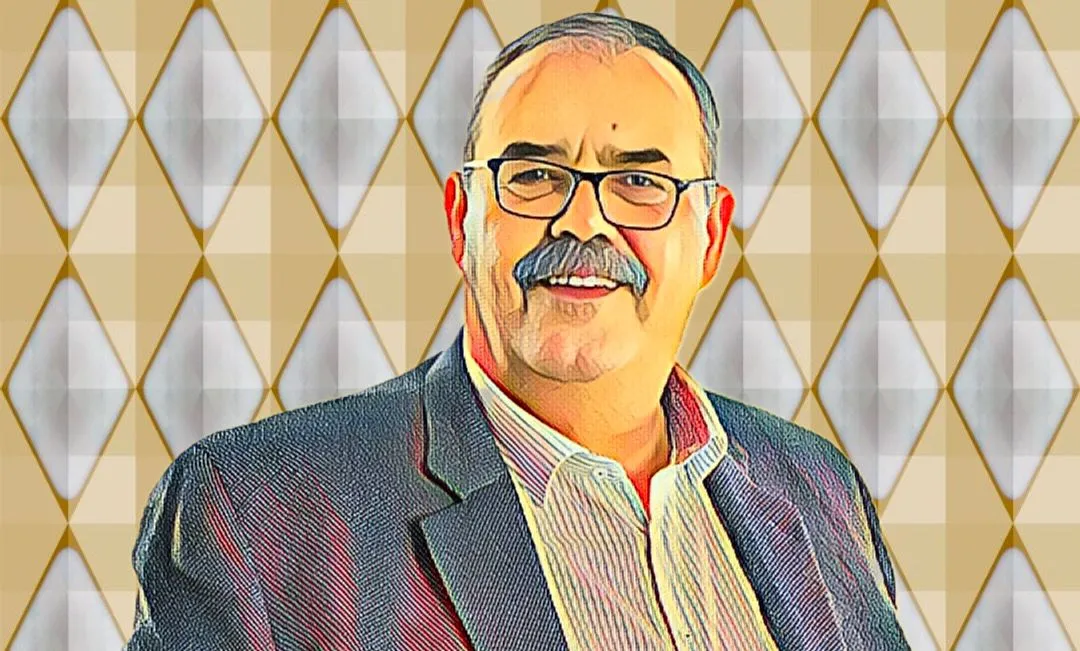

Egyptian tycoon Ashraf Sabry’s Fawry invests $1.6 million in three local tech firms

The leaders of the acquired companies welcomed the partnerships, describing them as valuable opportunities for growth.

Skip to content

Skip to content

The leaders of the acquired companies welcomed the partnerships, describing them as valuable opportunities for growth.

The move builds on Flutterwave’s aggressive expansion strategy, which has seen it secure multiple licenses across Africa.

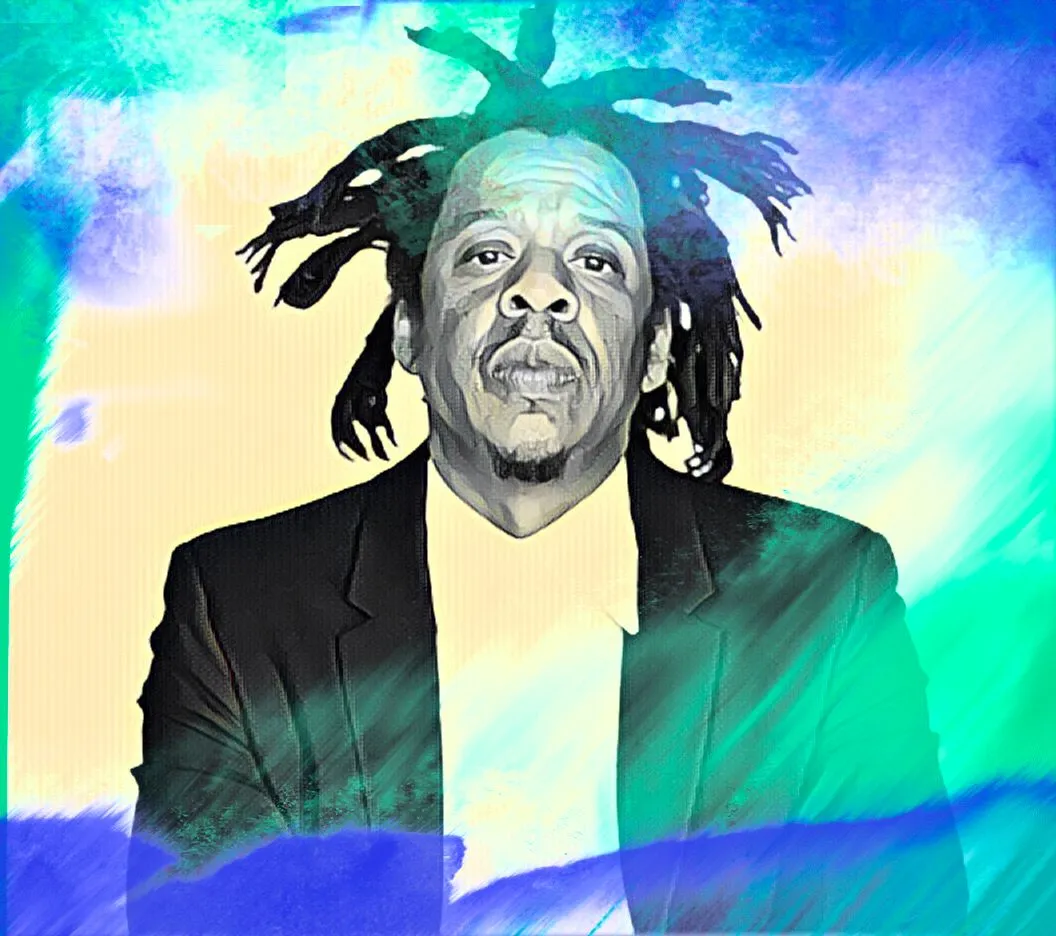

The decline follows a steep 16 percent drop in ARM’s share price over the past five days, with the stock sliding from R162 ($8.8) to R135 ($7.33).

The move reflects the growing financial strain on Kenyan businesses as economic pressures mount.

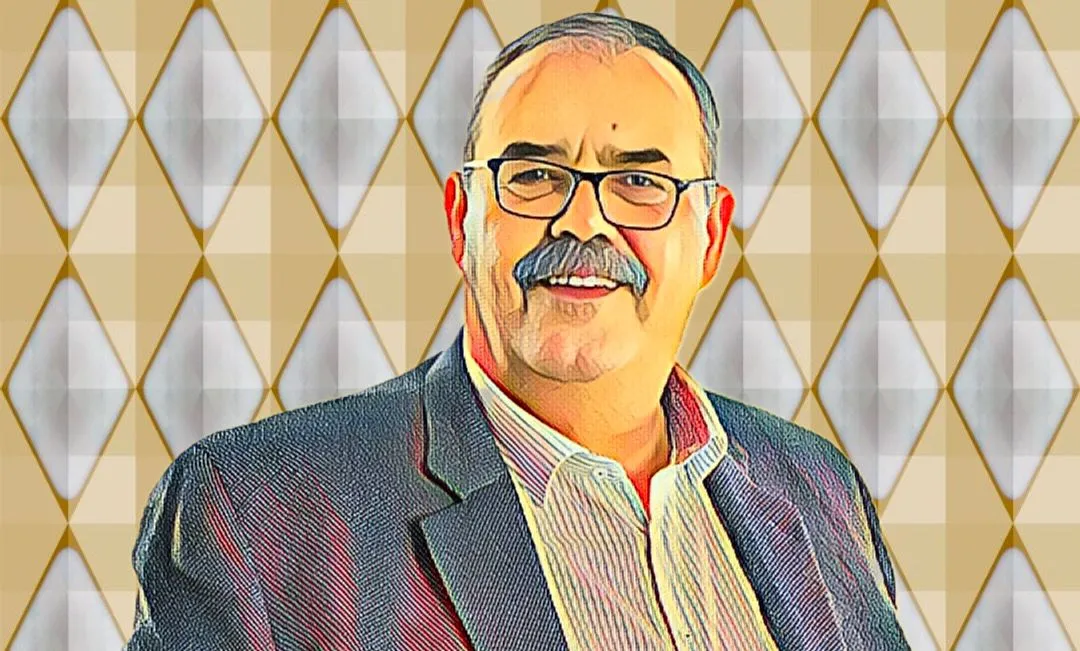

Beyond music and liquor, Jay-Z has built a strong portfolio in venture capital and private equity.

African Rainbow Minerals (ARM), led by Motsepe, forecasts a 55% drop in headline earnings on weaker iron ore prices.

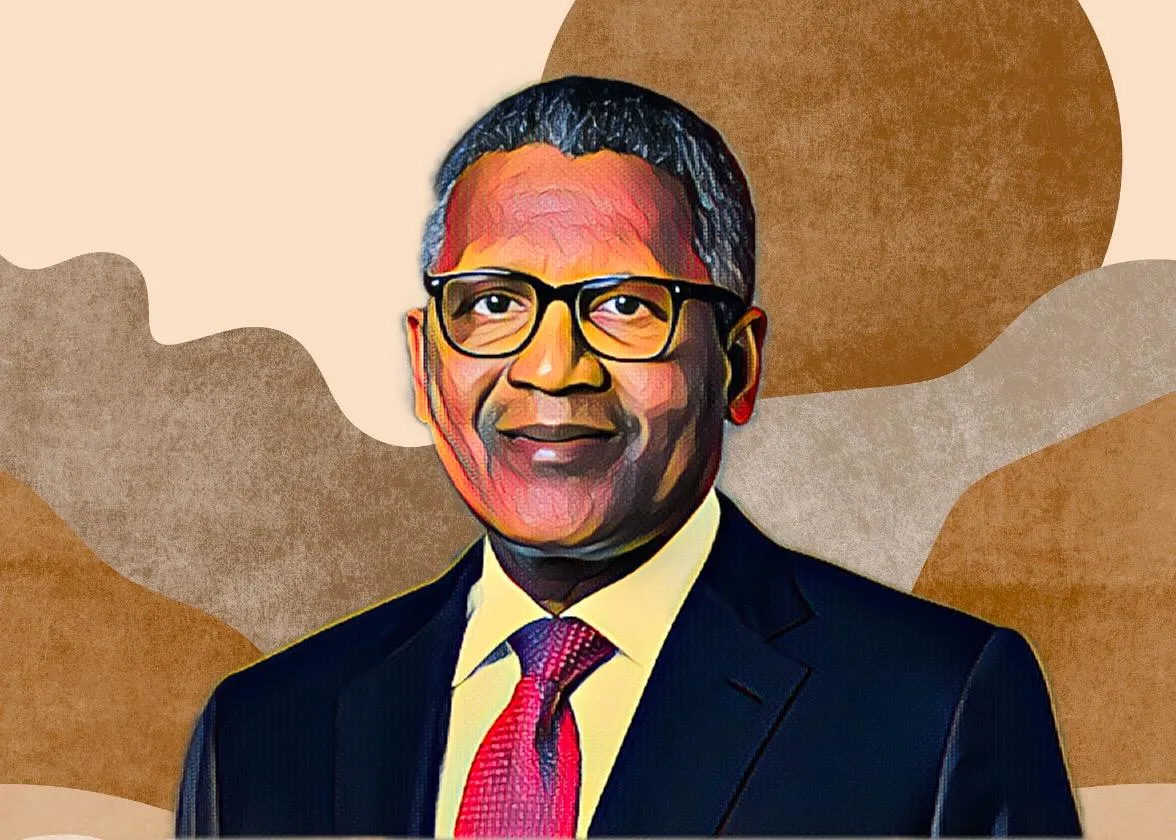

Beyond his social engagements, Otedola remains focused on leading two of Nigeria’s most influential companies.

This is tied to a slide in the market value of his 2.63 percent stake in Palantir, which has fallen from $7 billion to $5.3 billion.

This aligns with Nigeria’s broader economic recovery efforts under President Bola Ahmed Tinubu and aims to ease financial pressure on consumers.

The recent rally has driven Sam Darwish’s stake to nearly $50 million.

Nigerian cannabis mogul Bassim Haidar doubts Trump’s proposed “gold card” visa will draw a surge of global investors, pointing to concerns over higher taxes.

Sawiris cautioned that the ambitious projects require substantial foreign currency, straining Egypt’s economy.

Kirsh, who built his empire from a family sorghum-malt business in 1952, derives most of his fortune from his 75-percent stake in Jetro Holdings.

The recent rally in GB Corp.’s shares has pushed the Ghabbour family’s stake to nearly $234 million.

This sale marks a shift in her hospitality portfolio as she moves on from the property after two decades.

The decision comes after a legal battle with Jabavu Village Limited and Hasscon Pharmaceuticals Limited, which had borrowed the funds.