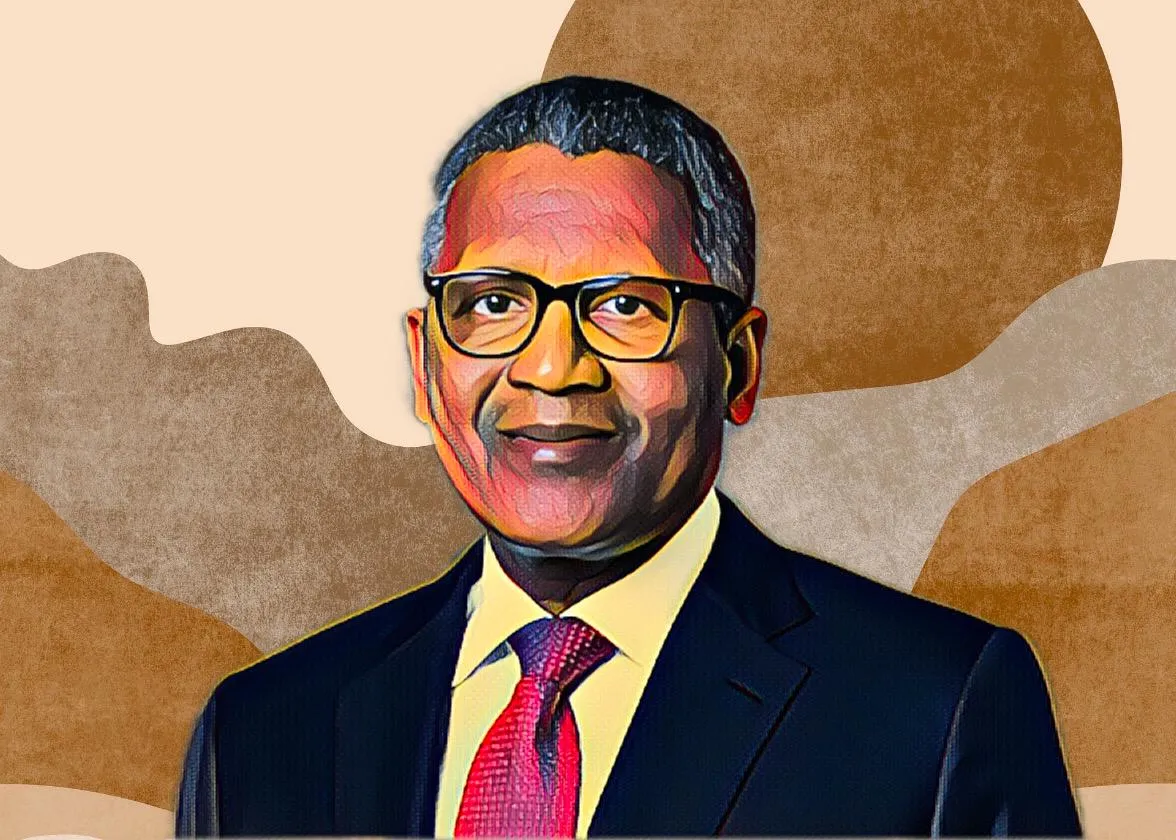

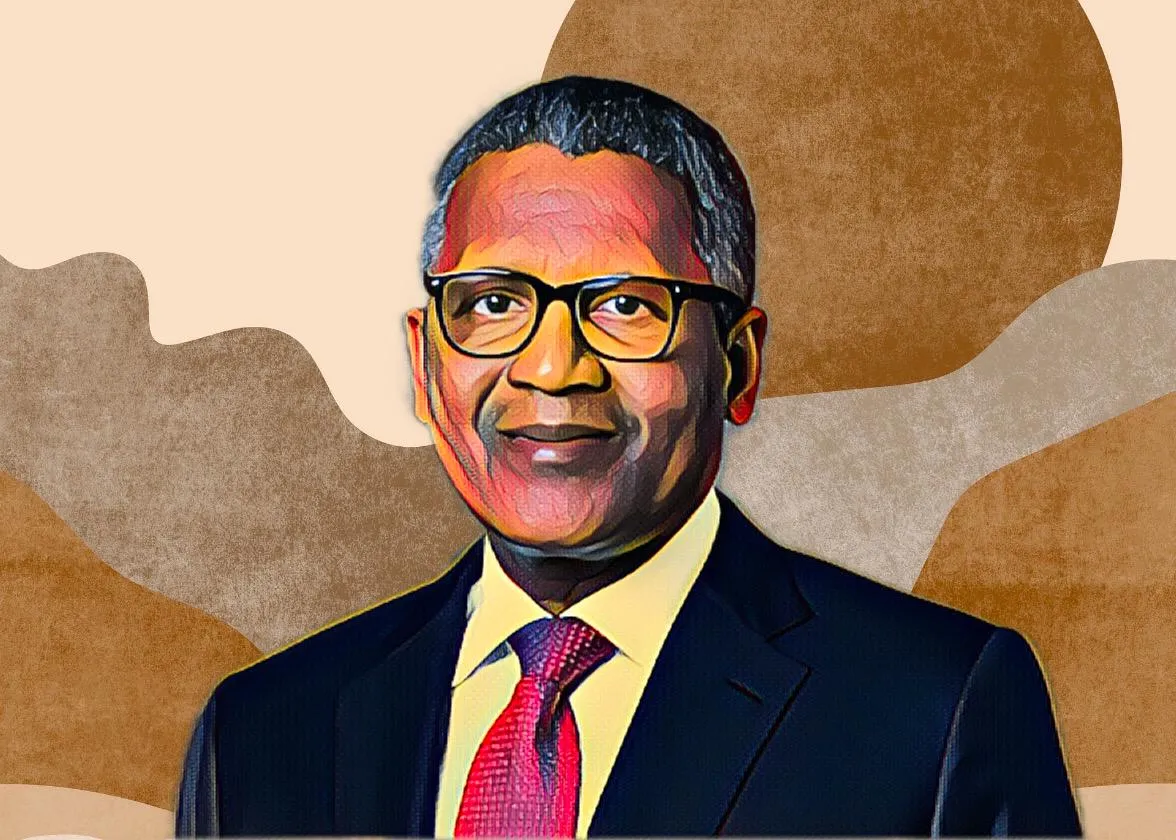

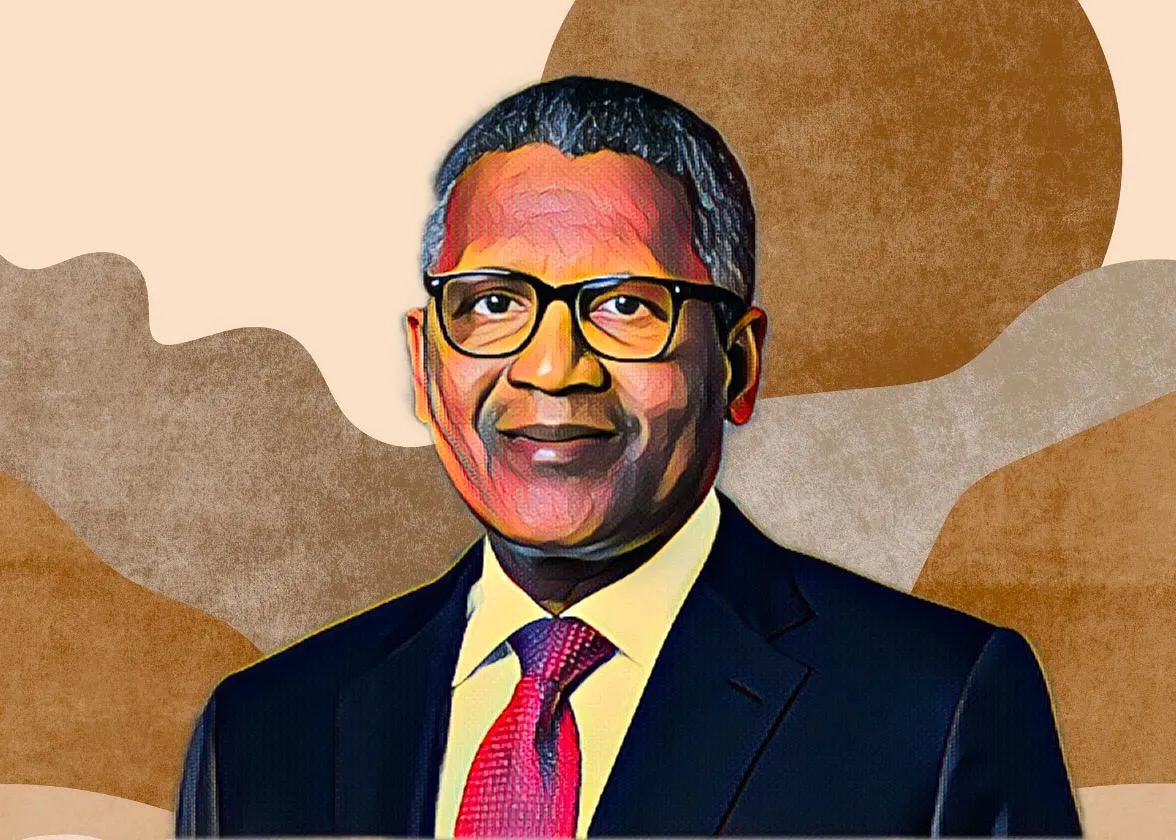

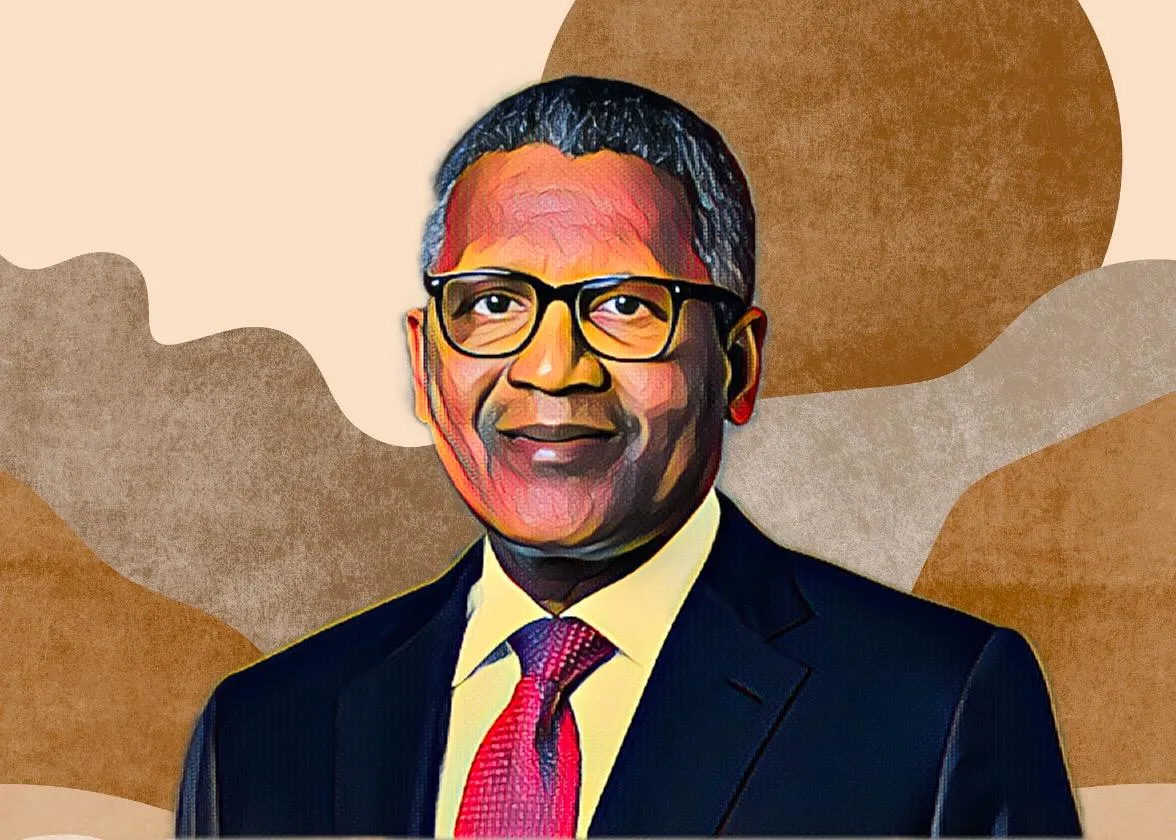

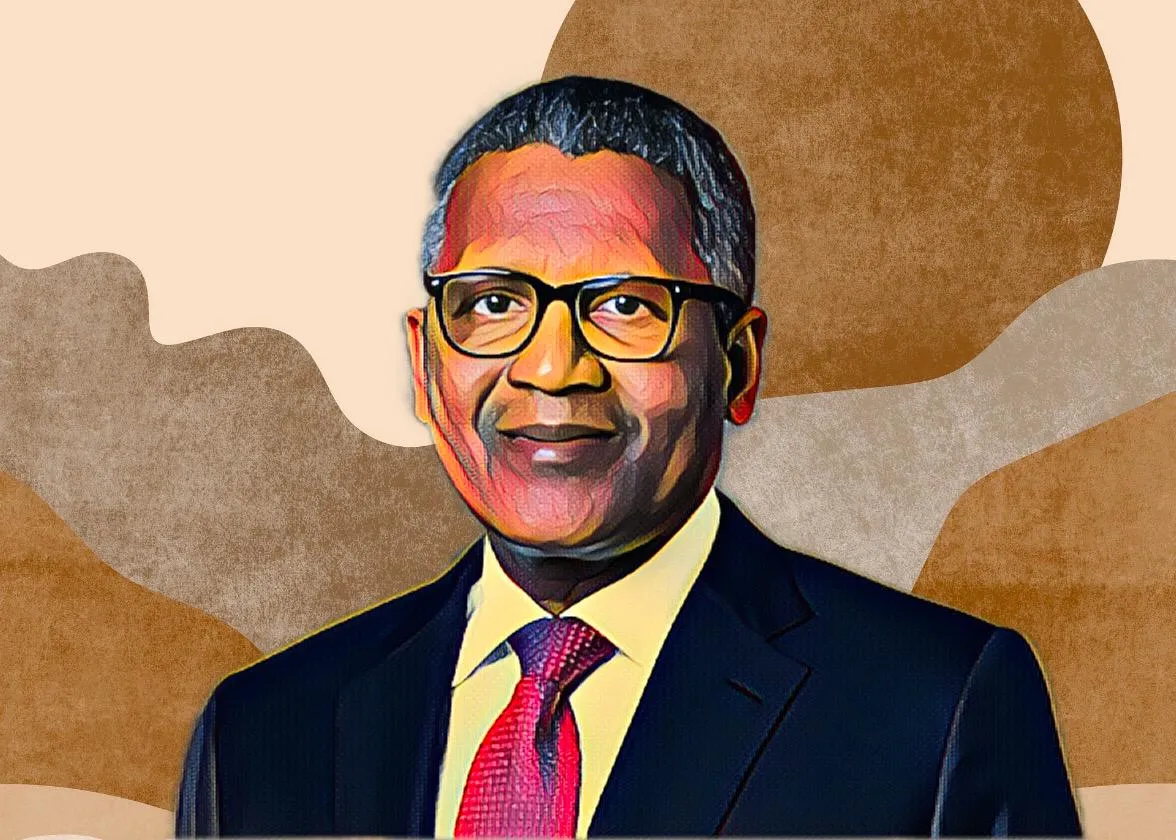

7 banks backed by African billionaires

With deep pockets and a sharp eye for opportunity, billionaire-backed banks are making a mark in corporate finance, wealth management, and financial inclusion.

Skip to content

Skip to content

With deep pockets and a sharp eye for opportunity, billionaire-backed banks are making a mark in corporate finance, wealth management, and financial inclusion.

The decision follows a major policy shift by NNPC, which scrapped the naira-for-crude oil swap deal just ten days ago.

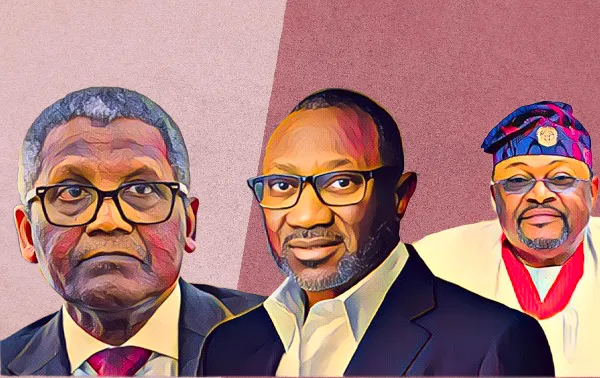

Aliko Dangote plans to build Nigeria’s largest seaport at the Olokola Free Trade Zone and resume work on a delayed 6-million-ton cement plant in Ogun.

The move is expected to drive up operational costs and could lead to higher fuel prices.

“I will be here very soon,” Dangote said, addressing fellow billionaire Femi Otedola. “And I want to congratulate you on this groundbreaking ceremony.”

Inside Africa’s richest man’s payday from his cement empire, Dangote Cement Plc.

Revenue from its Nigerian unit rose from N1.29 trillion ($860.6 million) to N2.19 trillion ($1.46 billion), helped by higher cement prices.

This aligns with Nigeria’s broader economic recovery efforts under President Bola Ahmed Tinubu and aims to ease financial pressure on consumers.

The increase is tied to his 86 percent stake in Dangote Cement Plc, Africa’s largest cement producer, which has gained nearly $200 million in value this year.

Reflecting on the decade-long journey to completion, Dangote told Forbes, “If this didn’t work, I was dead.”

Forbes’ latest valuation narrows the gap with Bloomberg’s estimate, though a discrepancy remains.

The move is expected to double the facility’s annual capacity to 5 million tonnes, strengthening Dangote Cement Plc’s position as Africa’s leading cement manufacturer.

A surge in the market value of his stake in Dangote Cement, Africa’s largest cement maker, has added $800 million to his wealth in just three day.

With this latest boost, his year-to-date loss has narrowed to $461 million.

The refinery last month announced plans to construct eight new crude storage tanks to secure a stable supply of imported oil.

From cement and construction to telecoms and finance, Nigeria’s richest businessmen have built empires that extend far beyond the country’s borders.